Unlocking Financial Potential: Exploring Capital Market Products

- samrudhlok8

- Apr 16, 2024

- 2 min read

What is Capital markets and Capital market products?

The capital market refers to the financial market where long-term debt and equity-backed securities are bought and sold. It encompasses a range of instruments and institutions that facilitate the flow of capital from investors to corporations, governments, and other entities seeking long-term financing.

Capital market products are financial instruments traded in the capital market. These products include stocks, bonds, derivatives, foreign exchange, commodities, and various investment funds.

Example: New York Stock Exchange (NYSE), where stocks, bonds, and derivatives are traded.

Different types of capital market products:

1. Stocks:

Stocks, also known as equities, represent ownership shares in a corporation.

Stockholders have a claim on the company's assets and earnings and may receive dividends and voting rights.

Example: Apple Inc. (AAPL) issues stocks that investors can purchase. Each share represents a fractional ownership in Apple, entitling the shareholder to dividends and voting rights.

2. Bonds:

Bonds are debt securities issued by corporations, governments, or municipalities to raise capital.

Bondholders lend money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

Example: U.S. Treasury Bonds issued by the United States Department of the Treasury. Investors purchase these bonds, effectively lending money to the U.S. government, and receive periodic interest payments until the bond matures.

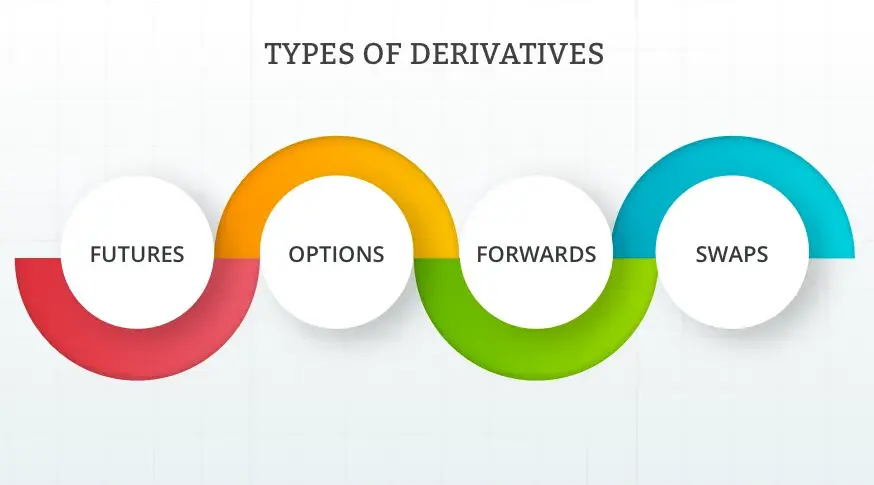

3. Derivatives:

Derivatives are financial contracts whose value is derived from the performance of an underlying asset, index, or interest rate.

Examples include futures contracts, options, and swaps.

Example: S&P 500 Index Futures contract, which derives its value from the performance of the S&P 500 stock index. Investors can buy or sell futures contracts based on their expectations of the index's future movements.

4. Foreign Exchange (Forex):

Foreign exchange refers to the global market for trading currencies.

Participants, such as banks, corporations, and investors, exchange one currency for another at an agreed-upon exchange rate.

Example: EUR/USD currency pair, where the euro (EUR) is the base currency and the U.S. dollar (USD) is the quote currency. Traders buy or sell this currency pair based on their views on the euro's strength relative to the dollar.

5. Commodities:

Commodities are physical goods, such as gold, oil, wheat, and coffee, that are traded in commodity markets.

Investors can trade commodity futures contracts or invest in commodity-focused exchange-traded funds (ETFs).

Example: Gold futures contract traded on the Chicago Mercantile Exchange (CME). Investors can buy or sell gold futures to speculate on the future price movements of gold without taking physical possession of the metal.

Each of these capital market products serves different purposes and caters to various investor preferences and risk profiles. They play essential roles in allocating capital, managing risk, and facilitating economic activity on a global scale.

Comments